RESEARCH PAPER:

STABILIZING THE

GLOBAL MARKET

Preface

I credit my endeavors to the success of this research paper to my Creative and Critical Thinking lecturer Dr. Dikir Maison Technical University of Kenya, who encouraged me that I could do it when I did my first paper in my first semester, first year about why is ICT productivity has been too low in Kenya.

I would also thank my friends who believed in me that I could conduct a private research paper and find a solution to this global menace as we straighten the payment industry and the market at large.

Thanks to my mum, Nelius Waigumo King'ori, dad Gerald King'ori Ndegwa who always told me NEVER to give no matter what comes on my way.

I salute all of you for giving me hope.

To all my readers, feel free to give a feedback by tweeting me @dcskenya, FACEBOOK dcskenya and can also visit my site www.dcskenya.com which seeks to;

REMOVE ALL ANTI-DIGITAL MEANS OF PAYMENT STARTING WITH CHEQUE AS WE CONFORM WITH THE GLOBAL MISSION; TO-EMBRACE-A-PURE-CASHLESS-SOCIETY IN THE NEAR FUTURE. AND THIS FUTURE STARTS NOW.

THANKS IN ADVANCE;

Stephen Ndegwa King'ori.

STABILIZING THE GLOBAL MARKET

For a quick grasp, check HERE

This research explores on the

payment systems that the world uses. It will explain the reason why cheque

still exists despite the presence of many diversified electronic payment

platforms. It will also aim at outlining the harmony of the universal payment

structure and how the market can be stable even when the declining cheque

undergoes a natural death.

cheque-drawing

CONTENTS

1.

Introduction

2.

Research

objectives

3.

Documented

statistics

4.

History:

genesis of payment demise

5.

Present: The

universal state of permanence

i.

The principle of dyad- vesica piscis (design)

ii.

Scientific payment analysis: Global market equilibrium/

stability

iii.

The law of diffusion of innovation

iv.

Conflict of laws: Reason for cheque’s existence

6.

SMEs and

cheque

7.

Future: Probable

results

i.

Scientific approach

ii.

SMEs approach

iii.

General view approach

8. Long-lasting solution

9.

Inspired

by nature: DCS

10. Reference

INTRODUCTION

Following

the cheque facts below:

-Cheque decline began in early 90s,

and by now, it has taken a global trend (www.paymentcouncil.org.uk)

-There has been a slow pace in

migration to digital payment platforms despite lots of efforts made. People

still use cheque-books despite the introduction of diversified electronic

platforms. And remember that no commercial promotion promotes cheque usage, not

the banks or the payment system monitors. (Research

analysis)

-Cheque still exist despite its

associated challenges like increased fraud, high processing costs, lots of

physical user involvements and vulnerability of cheque-books among others (see cheque fraud: Daily Nation 21-5-2013/

internet-Ref. M –pg 24)

-Quite a large number still use it

as an alternative means of payment in business and in daily transaction (93%

use EFTPOS, credit cards and online banking with cheque as an alternative,

whereas 7% use it as the main means of payment). -www.stuff.co.nz/business

(last posted 3rd Dec 2012 – Ref. C–pg 23)

RESEARCH OBJECTIVES

The key objectives of the project

research were;

A.

To find

out why do some people still use the inefficient cheque

(16th-century

technology), yet we have digital platforms specifically designed for the 21st-century.

B.

Find out

the source, if any, that could have contributed to this menace/ payment

disparity

C.

To

research on the actual reason behind slow digital payment migration (since

early-90s) till date, yet, cheques are associated with negativities like

increased fraud, high processing cost and user physical involvements.

D.

To

identify the repercussions caused by the end/ death of cheque towards the

entire payment system and global market in general.

E.

To come up

with a long-lasting solution towards the research outcome.

Going by global facts;

Ø Some

overseas countries (mostly European), think that cheque faces decline because

it is weak, obsolete, old fashioned or outdated. Yes, it is old-fashioned. On

the other hand, if cheque is indeed weak, then, it could have been phased out

in less than a decade. But in more than

two decades since competition began, it still exists.

Thesis: despite its associated challenges, cheque has something

special in it that makes it survive despite the competition and that no other

means of payment can satisfy.

Ø Secondly,

in 2009, when the UK Payment Council decided to discard cheque come 2018 due to

its increased decline, it was firmly rejected, stakeholders indicating that

unless another means that serves as cheques does is developed, cheques cannot

be discarded. (www.paymentcouncil.org.uk)

Thesis: cheque

has its place in the global payment system that none of the existing digital

payment can fill.

Sources/ some researchers say that

it exists simply because:

a)

It enables physical contact between the involved parties

during its transfer

b)

It helps keep records (the counterfoils and stubs)

c)

It is personal and secure due to signatures especially by

old people, among other reasons

d)

They are used in charities and fund donation programs

(over-sized cheques)

(RBA: Strategic review of innovation

in the pay system (www.rba.gov.au/

publications – reasons for cheque’s continued use) –Ref: J–pg 24)

USING DOCUMENTED STATISTICS FROM

CREDIBLE SOURCES

·

Going by UK Payment Council 2011 statistics on cheque usage: (Ref. D–pg 23)

Transaction distribution: 52% cash,

16% automated, 29% plastic cards, 3% cheque

Cheque users: 57% are old people (65

years +), - % use as alternative

·

Cheque and credit clearing company cheque statistics – (www.cheque-and-credit.co.uk/facts

-and-figures/cheque-market -Ref. E–pg 23)

-in year 1990, 4billion cheques

cleared, in year 2010, 1.1 billion, 72% decline.

-11% decline (2010), 13% decline

(2009)

·

Research on cheque use in UK (Ref. F–pg 23)

73% of old people (65 yrs +) heavily

use cheques – study by age in UK

·

Cheque decline, UK Payment Council portends that only 2

million cheques will be issued in 2017 a day compared to 11 million in 1990.

–Moneywise: Do you still use cheques (www.moneywise.co.uk) posted on 14th Jul 2009

(Ref. G–pg 23)

-7% rely on cheques as major means

-93% use EFTPOS, credit cards and

online banking with cheque as an alternative.

THE HISTORY/GENESIS OF THE PAYMENT’S

DEMISE

‘A disease can’t be diagnosed and

treated before knowing the cause/ root,’ so they (doctors) say.

I explored and analyzed on the history of

payments and the transition from ‘old’/ anti-digital/ non-electronic to the

new/ digital payments. This marks the reason for cheque’s existence.

In early 90s, before the

introduction of electronic and card payments, there were only two means to buy/

pay – cash and cheques (paper-form). Cash enabled people to acquire goods by

paying instantly as cheques enabled people to pay for goods of high values. Cheques

also, gave people power to possess goods with credit by post-dating them. When

the maturity date/ date of issue came the payee could take it to the bank for

cashing/ clearance.

In early 90s, due to the launch of

new infrastructure:

Ø The birth

of internet and the PC revolution which began in US which was driven by

companies like IBM, Microsoft, Apple among others which saw the development of

online payments like PayPal and other e-payment methods.

Ø The GSM/

SIM technology by ETSI in Europe, the mobile phone technology which led to

launch of mobile money transfers (digital wallets in US) and the recent

m-banking trend among banks.

Ø The debit

and credit card payment by companies like VISA, Master cards, Maestro, American

Express among others

Ø GIRO (UK),

SEPA (Europe) EFTPOS (Australia), US digital wallets and M-PESA (2007-Kenya)

have developed as a result of the payment revolution which has now taken a

global shape.

NB: the payment systems were

developed as from mid 90s onward (PayPal, the pioneer in online

transactions was launched in 1998, others have followed).

When involved experts were

digitizing payments, they did so by using the cash model which is instant and

empowers only those who have liquid money, and forgot to improve credit-buying

by improving the cheque model which was associated with the credit aspect,

thereby, creating imbalance the overall payment system. So, they did partial

job.

That is the reason why credit-buying

faces challenges prompting the dying cheque to survive, the reason why many may

wonder and doubt the existence of cheque whereas we have developed many digital

and secure platforms. The same reason makes many use it as an alternative.

This is a serious problem even in

the developed nations since they too are unable to stabilize the market saying

that let cheque exist while they close their eyes not to see the dark side of

them. But the problem is, cheques are declining / dying as every new day dawns.

(See: decline of cheques-internet).

What will happen 10 or 20 years to come, the time when cheques will end? What

will happen to people who use cheque-books as an alternative/ transacting way,

the 93% (see: Business day – www.stuff.co.nz/business - Ref. C–pg 23)

The only left benefit a cheque

offers is the flexibility of payment

period - (dated and post-dated); everything else is entirely pathetic;

-the increased fraud (See: cheque

fraud-Daily Nation21-5-2013/ internet -

Ref. M–pg 24),

-lots of user-physical involvements

-high processing costs per unit (in

UK is about US$4) - RBA: Strategic review of innovation in the pay system (www.rba.gov.au/ publications - Ref. J–pg 24)

-vulnerability and loss of cheque

books which marks the genesis of most fraudulence activities

-passed by time nature of papers

(anti-digital model)

-negative change in user’ tastes and

preferences, among others

THE UNIVERSAL STATE OF PERMANENCE

The world is always at equilibrium and

this is governed by a set of laws known as the laws of the universe. Physics and science laws are part of the

many universal laws. These laws aim at making the universe constantly stable.

And if there is outdoor fiddle of the way it operates, these laws will make

sure that it regains its all-time steadiness. For instance:

§ See the global

warming; it’s the process by which it is trying to regain its

permanence form as a result of the external attacks by humans. It’s worth

noting that by recovering; the effects must be seen and heard. So, a blunder

made today might be significantly felt a number of decades afterwards.

§ See the

recent Euro zone crisis, though this didn’t take long to show itself

(a decade since early 2000 to 2009), after Greece revealed the state. And it is

the advantage they have since the pressure did not compile itself for long, the

reason why the hit Europeans can recover in a relatively a shorter time.

§ More than

these global effects can be explained by looking at the root cause and mistakes

injected into the world by humans and the results are almost always hurting as

the universe tries to get back to its form of stability. In IT concept, we form

the INPUT, the universe PROCESSES and DEBUGS it and it gives us back the

OUTPUT. And since human is to error, most of the times we give wrong input

figures and since the world is always just, we get equivalent output.

With this universal solidity, this

payment ordeal can be explained. The imbalance/ partial job done while revolutionizing

the payment systems more than two decades ago, is now bearing the results, as

the state of equilibrium tries to rule. Taking note of two conflicting laws

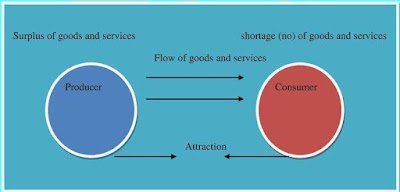

In production, distribution and

consumption of goods and services there exist a polarity between

the key participants i.e. the producer and the consumer. In producers, there is

surplus and mass production whereas on consumer side, there is shortage.

The difference attracts and brings

them together, where the flow of goods and services starts to take place. This

polarity that inherently exist, integrates them to make the market (common

place that allows free flow of goods and services from producers to consumers).

When they come together, other

participants find their way to the league to cement the relationship. These

include the intermediaries/ distributors/ retailers/ market brokers and agents.

Their aim is to facilitate time, place, and form of goods and services to

convenience the market deals for the larger parties’ benefit. That’s how the

market is naturally structured.

MARKET FORMATION (VESCICA PISCIS)

Using Vesica piscis, (a

symmetrical shape between two circle of the same radius where the centre of any

of them lies in the perimeter/ circumference of the other r) (-Ref. N–pg 24), the market place is

born.

Vesica piscis is famous and has been

used in history in areas of art, design and architecture i.e. Egyptian

pyramids, in museums and galleries, church doorways and now occurs in many

places like the national flag and court of arms of Kenya and logo of Church of

Scotland among others. It also occurs in nature e.g. two bean seeds facing each

other, the stoma opening among others.

The market is simply the integration

of the producer and the consumer who are both equally indispensable. So, it’s

the common thing both share and it exhibits the vesica piscis design.

Then, for the market to run

successfully, it has components that must run in order. They include;

commodity/goods of sale, terms of sale, prices and the means of payment to be

used. If any of these fails, the entire system fails to meet its purpose

effectively. So, any failures will make the market ‘poisoned’/ be in conflict

and as a result, it will tear both members apart as well as the other players-

the intermediaries.

An inherent market

i.

II. SCIENTIFIC PAYMENT ANALYSIS: GLOBAL MARKET EQUILIBRIUM/ STABILITY

This gives us the reason why cheques

exist despite the stiff competition and why its decline may create a horrific

situation.

Using the PRINCIPLE OF MOMENTS

(physics); in stable conditions/ equilibrium, the sum of clockwise moments from

the centre of equilibrium must be equal to the sum of anti-clockwise moments.

(-Ref. O–pg 24)

Following this thesis, ‘For the market and trade to be stable,

people must be able to buy in cash as well as in credit.’

Similarly, in payments, this law is

not left behind.

The cash model (all transfers that

rely on liquid money) represents one side while the credit model (all transfers

that enable people to buy in credit) represents the other side.

Using the law;

Ø Clockwise

moments =anti-clockwise moments

Distance A

x weight A1= (distance B X weight B1) + (distance C X weight C1)

Where;

·

Weight = number of transactions

·

Distance = system/ mode inefficiency i.e. distance increases

as inefficiencies increase and vice versa.

NB: The

arrows/ distances for digital platforms move towards the centre of the

equilibrium in the same pace while the one in cheques moves away from the

equilibrium.

Remember:

-

CREDIT CARDS appear on both sides because most

are the times when the users have to have funds in their revolving accounts to

enhance security of card use. So, it can mostly be referred to as a cash model

in that one buys only to pay later. The convenience it creates is that one

makes small shopping within a period of time only to be collectively added to a

single statement by the bank while billing. Hence, these cards cannot act as

replacement to cheques.

In declining cheque usage, the weight

decreases. And for the system to be in stability, the distance becomes larger just

to make sure that the product, (distance C X weight C1) remains constant. The

distance is widened by factors such as increased fraudulence, the high charges

for cheque processing, the vulnerability of cheques and cheque-books which are

prone to loss and theft which in turn mark the genesis of most of fraud

occurrences, the anti-digital scope especially in the current dynamic world,

(note that first cheque was drawn in 1659) so, not designed for the 21st

century, the lots of physical involvements within the payment process among

others. So, these challenges simply arise so as to make sure that the above

state remains stable. So, as technology advances, cheque becomes more and more

jeopardized.

The narrowing distances in the

digital payments towards the centre of equilibrium is brought about by the

increase in secure infrastructure and robustness as they become more

comfortable, convenient, and less physical, affordable due to increased

automation among others. This improvement is brought about by the advancement

in technology. This is simply because its format is not technologically

supported.

With this analysis, shows that

science controls peoples’ behavior i.e. it goes hand in hand with how people do

things like the UK Payment Council’s decision and peoples’ objection, just to

see the system remains stable.

Going by the above aspect, phasing

cheques out of the game is somehow worse than keeping, despite the escalating

inefficiencies and high costs incurred, because it will create instability

within the market. The system will topple over in the left side. This is

because credit cards alone cannot hold it or move in the right direction not

unless we increase its inefficiencies which will make life more difficult. And

this is the reason why UK Payment Council failed to discard it. So what do we

do?

See how astonishing the universe

tries to be stable;

v As cheque

use declines, the inefficiencies increase to make the system stable, not to

wipe them. See its behavior in the above system.

v The UK

Payment Council 2009 decision to delete cheque out of the system come 2018 came

to a halt as a result of objections from politicians, businessmen, charities

and other organizations. They said that not unless an alternative is fully

developed, cheque is bound to stay.

v Lots of

advertising is done to promote use of digital systems. No one puts a cheque ad

but they exist despite the campaign against them. This is because the law;

principle of moments states that it (cheque) or its replacement should be there

for a stable market. [THIS SHOWS THE DIFFERENCE BETWEEN WHAT SCIENCE KNOWS AND

WHAT BUSINESS DOES]

i.

THE LAW OF DIFFUSION OF INNOVATION

This law is of essence here. It

states that for an innovation to take a global perspective, it undergoes a series

of 5 key stages so as to become a mass market product. (-Ref. P–pg 24)

The key stages are five (5) explained

according to the time and how fast people perceive and adopt it, namely;

a)

Innovators-(2.5%)

They are the first people to adopt it. They

are young in age, of high social class, have great financial lucidity and have

closest contact to scientific sources and interaction with other innovators.

b)

Early adopters- (13.5%)

They are second to adopt. Younger in

age, have higher social status and with more financial lucidity.

c)

Early majority (34%)

These are slower and take more time

to adopt than the above two. They will not try anything before the innovator

and the early adopters try. They have average social status and have contact

with the early adopters.

d)

Late majority (34%)

These will adopt after the average

member of the society. They have high degree of skepticism and will join after

the majorities have. They have below average social status and with very little

financial lucidity.

e)

Laggards (16%)

These are the last to adopt. They

have little or no opinion leadership. They tend to focus on ‘tradition’/ use of

old ways of doing things. They are the oldest of all in age and in contact with

only family and close friends.

Since early 90s, we started adopting

the new e-payments since they offered future to us. In digital payment mass

migration, these stages have not been left behind. And for a period of more

than two decades, most of these stages have passed. Yes! We are in the digital

era.

Following UK statistics, 57% of

cheque users are old people, of age (65 years +). We can partly say that we are

in the final stage: the laggard. The remaining 43% is mostly used by young

people who use cheque as an alternative means of payment. So, cheque is

difficult to be phased out as it is used in combination with other modern means

of payment.

How

cheque-books will end.

Ø 57% of

cheque users are old people, of age (65 years +) (- Ref. F. –pg 23)

In 5 to 10 years time, some of these people

will be dead; others will grow old in a way that they will not be able to

transact for themselves hence they will use their children and grand children

to transact for them. Since these are digital, they will use the digital means

of payment. So, the 57 % might be even less than 10% hence the overall

percentage will be around half the today’s figures.

Ø Cheque and

credit clearing company cheque statistics (-Ref. E–pg 23)

In year 2011, transaction

distribution in UK: 52% cash, 16% automated, 29% plastic cards, 3% cheque

Portended: in 10 years to come (in 2021),

there will be 60 % decline in cheque usage.

ii.

CONFLICT OF LAWS- REASON FOR CHEQUE EXISTENCE

Now we have 2 conflicting laws:

The

law of diffusion of innovation which shows the progress and stages

of adoption of an innovation states that cheques must end. This is because since

we started the journey to digital migration about two decades ago, at some

time, we must reach our destination. Right now we are in the laggards stage

characterized by mainly old people (see 57% users in UK are old people, 65 yrs

plus). The actual reason for natural death of cheque (strength of this law) is

the nature – anti-digital. Technological advancement continues to imperil it.

{Check the how below: Cheque-book’s

death mechanism}

The principle of moments indicates that unless an alternative is fully

developed, cheque is bound to stay, so as to achieve a stable market system. This

law balances between two sides of a system in equilibrium as shown above. As

happened in UK, cheque is bound to stay not unless an alternative is fully

developed.

These are two conflicting laws. This

tussle has made the digital migration to be slower than portended by experts

and analysts. Even if product promotion is done to influence people use digital

payment methods, the law (the principle of moments) stands as a setback. No one

promotes the use of cheque, but it’s used: Because the law demands so, though,

for some time.

PROBABLE RESULTS

The fear is, cheques are dying

naturally as they are undergoing a terminal decline. Even if we will not discard

them, they will continue to decline. What will happen 10 or 20 years to come?

How will we smoothly manage the decline as we welcome the digital platforms?

What about the traders who use cheque-books as an alternative means when they

lack liquid money and they want businesses to thrive?

1)

Cheque is undergoing a natural death. Its continued decline

before an alternative after sometime, scientifically, the market will not be

stable.

2)

In 5-10 years time, cheque will be the most expensive means

of payment following increased fraud (by tech-savvies) and high processing

costs by banks.

3)

With no exertion, in 5-10 years time, a crisis I may call

global market crisis will set in. the wrong pull out of cheque from the market

will result into a Global Market Crisis (GMC) menace. This is because;

v Cheque is

a global means of payment whereas most of the digital platforms operate within

localities.

v It has

existed in more than 35 decades hence it has a strong/ robust rooting system in

the market whereas the digital platforms merely exceed two decades.

v Cheque has

a niche in the market following its specialty in which none of the other means

of payment has tapped, hence, its long existence and survival amid its

inefficiencies.

4)

Cheque’s wrong pull out in the market will affect other

means of payment because it is influential and has an integral/ pivotal role in

stabilizing the global market. [System way and a bank withdrawal instance],

remember that the market is scientifically inter-connected.

There are 3 approaches that can help

us portend the future of cheque, of the payment industry and the market at

large. They are;

a)

Scientific approach

b)

SMEs approach

c)

General view approach

I.

SCEINTIFIC APPROACH

© For a

stable market, 50% decline in use (weight, w3) - as seen in the law of diffusion

section; how cheques will end -, should come with double the

inefficiencies (distance from the centre, d3 – as seen in the principle of

moments).

Since this

may not be achieved following the almost reach of climax/ optimum by these

inefficiencies, doubling them may not be realized. Then, scientifically, the

market will not be stable. As science controls peoples’ behavior, dictated by

2009 UK people’s decision, then, people’s buying behavior will be negatively

affected. This is where the global market crisis sets in.

© Due to

increase in efficiencies, people who use cheque will suffer its expenses

© Cheque’s

wrong pull out in the market will affect other means of payment. Due to its

role in stabilizing the market (as analyzed by the principle of moments), its

death will affect everything as they are all inter-connected.

© In the

longer run, as the universe tries to regain stability, the situation might be

globally painful and hurting, the degree that we may not be able to predict.

Crisis effects (as analyzed below) will now be seen and felt.

And this

give us a good hint: If we were keen enough to spot cases like global warming

before they find us unaware and explode, maybe, we might be in a better place

than we are. We may not be experiencing the global climatic change, extreme

heat, low agricultural yields as a result of unpredictable rainfall, the

instant floods which sometimes lead to loss of lives like the recent

Philippines’ typhoon, Katarina in US among others.

This is because, as the law of cause

and effects do exist, all results we see have their causes intact and we can

trace them in yester years.

II.

SMEs APPROACH

Today,

cheque usage has been left in the hands of SMEs. They are heavily in use of

them for B-2-B (business-to-business) and B-2-C (business-to-consumer)

transactions.

-

74% of

SMEs use cheque for B-2-B transactions in UK (www.bacs.uk/Document library, posted on June 2013) (-Ref. Q–pg 24)

-

RBI to

introduce schemes to charge more on cheques so as to force SMEs shift to

e-payments (cheque dis-incentivisation) - www.naavi.org, posted on 15th Feb 2013. (-Ref. R–pg 25)

-

[60% of

SMEs in Ireland still use cheque on monthly basis. 97% of businesses still

accept cheques. (2nd April 2014 report) -Ref: I–pg 24]

-

In

Malaysia, SMEs to gain from cost-effective e-payments, where they will save up

to 1% of GDP annually – the Star online. (www.thestar.com>Home>Business posted on 14th Feb 2014) (-Ref. S–pg 25)

Despite continued decline in use and

rise in inefficiencies, SMEs still find solace in them simply because fund

liquidity is an issue to them. Unlike large corporations that fund their

expansion strategies via the IPO aid and being listed in their security

exchanges, cheap credit like bank loans and funding from venture capitals, SMEs

find it hard to access such capital. To them, bank loans and funding from

venture capitals sometimes is unavailable option due to high interest rates on

such loans and/ or lack of collateral securities, difficult conditions and

restrictions rendered by venture capitalists. These two aspects limit them,

pushing them to use credit buying which is only made available by cheque-book. In

fact, 31% in UK states that they use cheques because they enable them for differed

payments. (www.bacs.uk/Document library, posted on June 2013) Hence, most of small transactions

are left in the hands of the down-trodden means of payment and it is hard to

alter this situation. Why? Cheque is the only standing legal document

that can enable one to buy in credit (by post-dating them).

According to Cheque usage statistics

(Business day) – www.stuff.co.nz/business (last

posted on 3rd Dec 2012), 93% use cheque as an alternative, (mostly SMEs), use

it for survival, growth and expansion (The circumstances/ instances/ occasions

where cheque seems the only means available).

NOTE: there arise moments when customers need

products and retailers have not stocked them at the moment and they don’t have

liquid money to purchase them instantly, so, they (middlemen) have to approach

suppliers by credit, where they post-date cheque. With this differed payment

scheme, they maintain the smooth flow of products. So, B-2-B transactions do

well with cheques among SMEs.

Cheque can disappear from the system

in two ways; forcing closure of clearing systems or the natural death they

are now facing. Either of the two is not a walk in the park if not handled with

care.

Forcing closure to cheques so as to

welcome e-payment alternatives and so as to save economies money as to be done

by most European countries and India is not an excellent deal. What will happen is that they will hurt SMEs,

limit their functions and expansion and lead to their collapse. Free/ smooth

flow of goods and services to users will not be attained. Effects will ultimately

result; unemployment issues and down fallen economies because this sector

represents the building blocks/ pillars of many economies. Shortages will be

the order of the day to users, hence, price hikes. Though large corporation

will be in a position to have mass production, distribution of their goods to

the end-consumer will be a challenge as most distribution channels are offered

by SMEs who are the retailers/ middlemen/ intermediaries. And this is where we

say that the market is ‘poisoned’ as illustrated by the vesica piscis diagrams,

(see it below), preventing free flow of goods and services.

On the other hand, if cheque is left to take

its course, the continual decline and increased inefficiencies will make

business operate in the hard way known before something fatal blow up in

outrage. So, impetuous handling of cheque holds with it a death sentence. No

jest.

III.

GENERAL VIEW APPROACH

This outline the actual mechanism in

which cheque has and will continue to follow on its journey to the books of history.

Cheque’s decline has been initiated by a number of reasons, namely;

a) The

introduction of the digital payment system in the mid and late 90s

b) The

advancement of the 21st technology that sees and guarantees more of

cheque insecurity and minimal survival chances in terms of fraud

c) Increase

of cheque inefficiencies due to its anti-digital nature in the presence of

most-efficient platforms

Cheque-book’s

death mechanism (CDM)

Cheque, as a means of payment, is

anti-digital. This is because it was founded in 16th century; hence,

its format is not technologically supported. So, as technology advances, cheque

becomes more and more jeopardized. In recent years, cheque fraud has been on

its height since it has shifted from a mere mechanical approach to a more

sophisticated technological scope. Tech-savvies are now the one who are taking

the cheque’s survival opportunity to defraud banks. Then, banks, as a way to

recover some of these losses, charge higher in processing cheques, thus, it

becomes more and more expensive means of payment.

Cheque being expensive has and will

discourage people from using it, hence, its usage will continue to decline.

Reasons for further decline will be:

Increased fraud and high processing costs which will discourage people from

using them, hence, the decline.

Cheque fraud is said to rise at an alarming

rate. (See 25% increase in USA annually:

ABA report 2009) - 760 955 cases of fraud were reported in 2008 and $1.024

billion loss was made (2009 ABA study)-source: www.stopchequefraud.com. (Ref. F–pg 23)

- Using the vesica piscis approach,

when a component of the market (cheque, which is a means of payment) fails to

respond in the right way, the market at large is ‘poisoned.’ This prohibits its

normal behavior and the parties are set apart

The intermediaries, mostly SMEs, are

‘thrown outside the game,’ hence, they lack jobs. See the entry of

unemployment. The situation also lowers trade volumes as there is no longer

free flow of products of which instigates the entire GMC outbreak. The little

goods on consumer side are bought on the issue of ‘the highest bidder,’ resulting

to escalating prices.

GLOBAL

MARKET CRISIS (GMC)

It is a situation where the global market is not functioning the way it should/ there is a conflict/

or friction and the normal distribution of goods and free flow (of goods) from producers to

consumers is not realized with ease. We say that the market is ‘poisoned.’ When there is shortage

in the side of consumers, prices escalate whereas in the side of producers, there is mass

production and wastage. Intermediaries (mostly SMEs) are facing difficulties in operating their

businesses where most lead to closure and collapse, (no wonder why they are the main users of

cheques globally). Following this is the loss of employment and cases of redundancy as these

employ over 60% of people, degenerating economies as they are the building blocks of any state

economy. This also leads to low trade volumes both locally and internationally and many states

are unable to meet their objective as their major source of revenue if from taxation, i.e. Low

custom duties, corporation and PAYE taxes are the one that are collected. Practicing extreme

austerity measures like cutting salaries and lay-off of civil servants and employing doubletaxation to the only surviving businesses will only hurt citizens more.

And since the market is the heart of all other sectors in economy, they start crumbling for

instance; little business leads to low savings and shrinking of loan-books in banks, hence, poor

bank performance. When there is little goods enter the distribution channel, little is transported to

the market-place and near consumers geographically, poor transport performance. There are few

businesses to be insured and the one collapsed have to be indemnified so, insurance companies

cry a lot. When businesses collapse and economy is hampered, people lack the purchasing

power, so, little is bought.

“NB: cheque, scientifically, stabilizes the market globally. For it to do so, it needs a minimum

number of transactions I may call it the threshold value. We are in this threshold value that’s

why the current decline is slower that it was before (see in the cheque decline graph) After a span

of time, the complex forces, as described in the general approach, will make users revolt from

using them, hence, the number of transactions will fall below this threshold value and it will not

be able to maintain its role and the market will not be stable scientifically, if we lack an acute

substitute. This is where the GMC sets in [a scientific certainty, not mathematical]

Right now we have the crisis only that it is within the limits/ it is contained. The people who are

now paying dearly are the cheque users. And since all crises are progressive in nature, as decline

in use continues, the scenario will change. It will explode and affect the entire market; lower

22

trade volumes, affect economies, affect governments, bring in inflation, and lead to

unemployment and redundancy cases among others.

Not unless we develop an alternative before that natural/ ‘forced’ time comes, we will find

ourselves in a state where we will not be able to withhold the pressure that will result from the

explosion. This will be more than the current Euro zone crisis in Europe or the global financial

crisis– is like a death wish. This is because, as explained earlier, everything in the world is held

by universal laws and physics laws are part of them.

With expensive cheques, people will shift from using it (see the above CDM analysis). Since it

has no acute alternative/ substitute (as seen in UK 2009-episode and its long existence despite its

inefficiencies and competition from e-payments) then, people who use it as alternative – the 93%

may not buy. Not that they will shift to the available e-payments, and when circumstances/

situations that forced them to use cheque appear, they will not buy because the available means

will not satisfy them.

CURRENT MARKET CONDITIONS THAT WILL TRIGGER GMC

Right now, this GMC ‘smells,’ it is in the offing. For any crisis to occur there must be a presence

of conditions favorable for its induction. The following are live and ‘kicking.’

01. The current market inconsistencies where people and businesses, especially SMEs, are

still using the expensive and inefficient cheques despite the presence of diversified digital

platforms specifically designed to suite their desires.

02. Where cheques are mostly used; SMEs in B-2-B transactions. So, when they revolt/ stop

from using them, the distribution channel of goods and the market at large will be

adversely affected.

03. Power of cheques to activate the GMC scenario (as discussed in the ‘probable results’ sub-title); cheque will affect the entire market.

GRAPH OF CHEQUE’S DECLINE PERFORMANCE GLOBALLY

NB:

- Some countries and continents faced a rapid decline and they are the countries that will

reach and experience GMC first. They include most of

EUROPEAN COUNTRIES, UK

and

AUSTRALIA

- For slower initial and late decline, other countries and continents will be there later. They

include some BIC countries like

CHINA, SINGAPORE, RUSSIA, USA and the

AFRICAN continent. (see cheque use in these BIC countries in Ref. U pg 29 )

- Though these

BIC Countries will experience the crisis later, they’ll be affected most as

they practice intensive and mass production and sale. And since Africa is in the

transformation mode, the threat is also meant to be equally severe as its counterparts,

since it might take the wrong turn.

- Other countries and continents occur in between the time bracket and their reach at the

point will be dependent on the rate of decline they are undergoing.

-

By 2022, all countries and continents in the world are meant to start feeling this menace.

By 2030, the effect is so intense.

From the graph;

A – (In 1990)

Cheque use at peak before it started declining

1. A-B - (from 1990-to-2010/2014)

Real decline is seen as e-payments get more of adoption in the market. It is up to a

certain point and year where the decline in use starts slowing down the pace (about two decades

since the decline commenced)

.

2. B-C – (from 2010-to-2018/ from 2014-to-2022)

Decline slows as number of cheque transactions nears the threshold value needed to

stabilize the market. It is withheld for sometime before the hell breaks loose. Right now (in

2014), we are all in this section.

3. C- (between year 2018 and 2022); - Year of GMC commencement:

Threshold value is no longer maintained as a result of the stretching and heaping up of the above

conditions that make it favorable for the triggering of GMC. There leads to its outburst where

from then, cheque usage start dropping and GMC complex outcomes starts to be seen

25

4. C-D – (from 2018-to-2025/ from 2022-to-2030)

Due to several factors, forces and complexities, cheque use drops swiftly and

drastically. The market is no longer stable and here, GMC rules. Here, the GMC ramifications

are felt.

LONG-LASTING SOLUTION

If a problem can be explained scientifically, its solution also needs a scientific approach. When

dealing with laws, there are only two ways to address them so as to achieve one’s desired

objective:

Conforming with the law

Counter-effecting the same law- (Wright brothers’ deal with the law of gravity in

making of the first man flight)

a) Conforming with the law

We have done it, waiting the laws to fight- ONLY THE STRONG TO SURVIVE.

This will crash the market whereby the law of stability will take cause and humiliate the SMEs.

b) Counter-effecting the same law

When Wilbur and Olive (Wright brothers) thought of building the first plane, it was known that ONLY birds could fly. NOTHING ELSE would defy the law of gravity, except for Christians -Jesus Christ DID. Conforming with the law (as in a) above) would have led the guys drop the project altogether. NOTHING COULD DEFY THE LAW OF NATURE; GRAVITATIONAL FORCE. Even if they build it using the lightest material, say...polythene paper or aluminum metal, could NEVER take off.

They thought otherwise. If they put a propeller on top of their plane, when it rotates, it would increase the speed of air around it. With BERNOULLI LAW/ EFFECT which states that when the speed of fluids (air included) increase, pressure lowers. So, the resultant pressure on top would then be lower than the pressure underneath which, with little force, the plane would take off. So, they counter-effected the gravitational force with Bernoulli law in their favor.

With the principle of moments, we need cheque or its alternative so as to maintain the stability of

the market and user-satisfaction. With the law of diffusion of innovation, if we have an

electronic platform, the better because this is where we are all heading to. Besides, we will have

solved the issue entirely as current cheque-bookers will find a platform to lie on when chequebooks are over (following the cheque’s death mechanism)

NOTE:

What detonates the

GMC is lowering of trade volume/ lack of free flow of goods and services as

a result of current cheque-book users having not fully transiting to full e-payment systems as the

latter fail to entirely satisfying their market needs. So, market is filled with a crisis and flow of

goods becomes irregular.

So, an acute replacement offered by a decent platform for the current suffering people/ will also

harmonize the payment industry because these users will automatically shift to it (following LDI

way), hence, no trade volume will lower/ no business closure/ no shortage of goods by

consumers/ no retarding economy.

INSPIRED BY NATURE: DCS (www.dcskenya.com)

DCS is a system that has been inspired by science and not business. The above research has

prompted me to edit an already designed an electronic platform (still by me) that will give

26

people the purchasing power regardless of whether they have liquid funds or not, provided they

have the credit worthiness. It enables the flexibility of the payment period, the secret behind

cheque’s existence. It is earmarked to enhance the global market stabilization, in short and longrun as it will also smoothly manage cheque decline as we hop and jump towards the gate of more

pure e-payment.

This new system is meant to solve the entire problem as it wishes cheque-books a peaceful

ending. It tends to launch a fraud-free, convenient and instant, less physical, 24-hr and portable

substitution to paper cheque books, a 21st century market stabilizer in the economy.

Moreover, one has total control of any DCS transaction because it is easy to track payments as

well as ease in accounting due the presence of statements.

As I said, for the market to be stable, people must be empowered to have the purchasing power

whether they have liquid money or not at the time of need provided they have the credit

worthiness (mostly businessmen, so as to facilitate smooth flow of goods in the distribution

channel). They must be able to buy at any time they need. This system offers both.

This system also offers a smooth transition from the declining cheque-book-using to the digital

money transfer platforms. It helps manage the decline in use of cheques, without destabilizing

the market at large and the economy in general, which remains a fear to most nations and

continents. It brings about the 2nd revolution in the payment industry- the cheque revolution a

successive scene from the first; the preliminary revolution in the digital payment industry

REFERENCE

A.

2018 target for phasing out of cheque in UK

–www.paymentcouncil.org.uk

B.

APCA to manage cheque decline – www.mybusiness.com

(posted on 16th may 2012, revised yr 2013)

-7% rely on cheques as major means

-93% use EFTPOS, credit cards and

online banking with cheque as an alternative.

D.

Going by UK Payment Council 2011 statistics on cheque usage:

Transaction distribution: 52% cash,

16% automated, 29% plastic cards, 3% cheque

E.

Cheque users: 57% are old people (65 years +), - % use as

alternative Cheque and credit clearing

company cheque statistics – (www.cheque-and-credit.co.uk/facts

-and-figures/cheque-market)

-1990, 4billion cheques cleared, in

2010, 1.1 billion, 72% decline.

-11% decline (2010), 13% decline

(2009)

-in year 2011, transaction

distribution in UK: 52% cash, 16% automated, 29% plastic cards, 3% cheque

F.

Research on cheque use in UK

73% of old people (65 yrs +) heavily

use cheques – study by age in UK

G.

Cheque decline, UK Payment Council portends that only 2

million cheques will be issued in 2017 a day compared to 11 million in 1990.

–Moneywise: Do you still use cheques (www.moneywise.co.uk) posted on 14th Jul 2009

H.

In US: 28 billion checks written in 2009 and have been

dropping by 1.8 bn per year – Philadelphia Fed Study. 2026 – yr of total

disappearance. (Business insider.com/ death of

cheques, posted on 13th Mar 2013)

I.

Irish payment services org (IPSO) report posted on 6th

Jun 2013

-62% decline in use for the last 5

years, value fell from €

J.

RBA: Strategic review of innovation in the pay system (www.rba.gov.au/ publications)

-

Cheque, expensive US$ 4 @ unit-yr 2007

-

Reasons for cheque’s continued use

K.

760 955 cases of fraud were reported in 2008 and $1.024

billion loss was made (2009 ABA study)-source: www.stopchequefraud.com. In USA,

out of $ 42 billion cleared, $ 500m was fraud (ABA 2012). It is said to

progress by 25% annually.

L.

ABA 2012 report: cheque fraud to rise at rate of 25%

annually in USA.

M.

In Kenya: fraud recorded in year April 2012- April 2013

(posted in Daily Nation 21/5/13)

-

1.5 billion loss; 30% being cheque fraud, 25% card fraud

N.

vesics piscis (for design) – http://

en.wikipedia.org/wiki/vesica piscis

O.

Principle of moments (physics) Physics book 2 / title: principle of moments/ publisher: KLB.

Also internet/ Google- moments

P.

Law of diffusion of

innovation (LDI) – you tube by Simon Sinek:

How great leaders inspire action.

Also internet/ Google

Q.

74% of

SMEs use cheques for B-2-B transactions in UK, 53% use them to pay bills. 31%

use them for differed payments. (www.bacs.uk/Document library, posted on June 2013)

R.

RBI to

introduce schemes to charge more on cheques so as to force SMEs shift to

e-payments (cheque dis-incentivisation) - www.naavi.org, posted on 15th Feb 2013.

S.

In

Malaysia, SMEs to gain from cost-effective e-payments, where they will save up

to 1% of GDP annually – the Star online. (www.thestar.com>Home>Business posted on 14th Feb 2014)

Thanks for the websites and journals

and books where I acquired reliable knowledge and credible statistics;

Websites:

The UK

Payment Council and Cheque and credit clearing company figures, the APCA

information and a number of media website posts like moneywise, My Business, Telegraph, Daily Nation (paper) among others.

Please visit www.dcskenya.com as you also wish to invest in what I term as a revolutionaly new way of embracing this global SMEs challenge as we give them hope and at the same time averting the portended GMC. NOTE that we have enough crises; global financial (2007-2009), global warming among others.